Tesla’s recent Robotaxi unveil at the much-anticipated “We, Robot” event has left the automotive world buzzing. CEO Elon Musk took the stage at Warner Bros. Discovery studio in California, showcasing the long-awaited Cybercab. Other exciting innovations include the Robovan and an upgraded version of the humanoid robot “Optimus.”

However, experts wonder if these announcements significantly impact Tesla’s share price or meet investor expectations.

The Highlights of Tesla’s Robotaxi Reveal

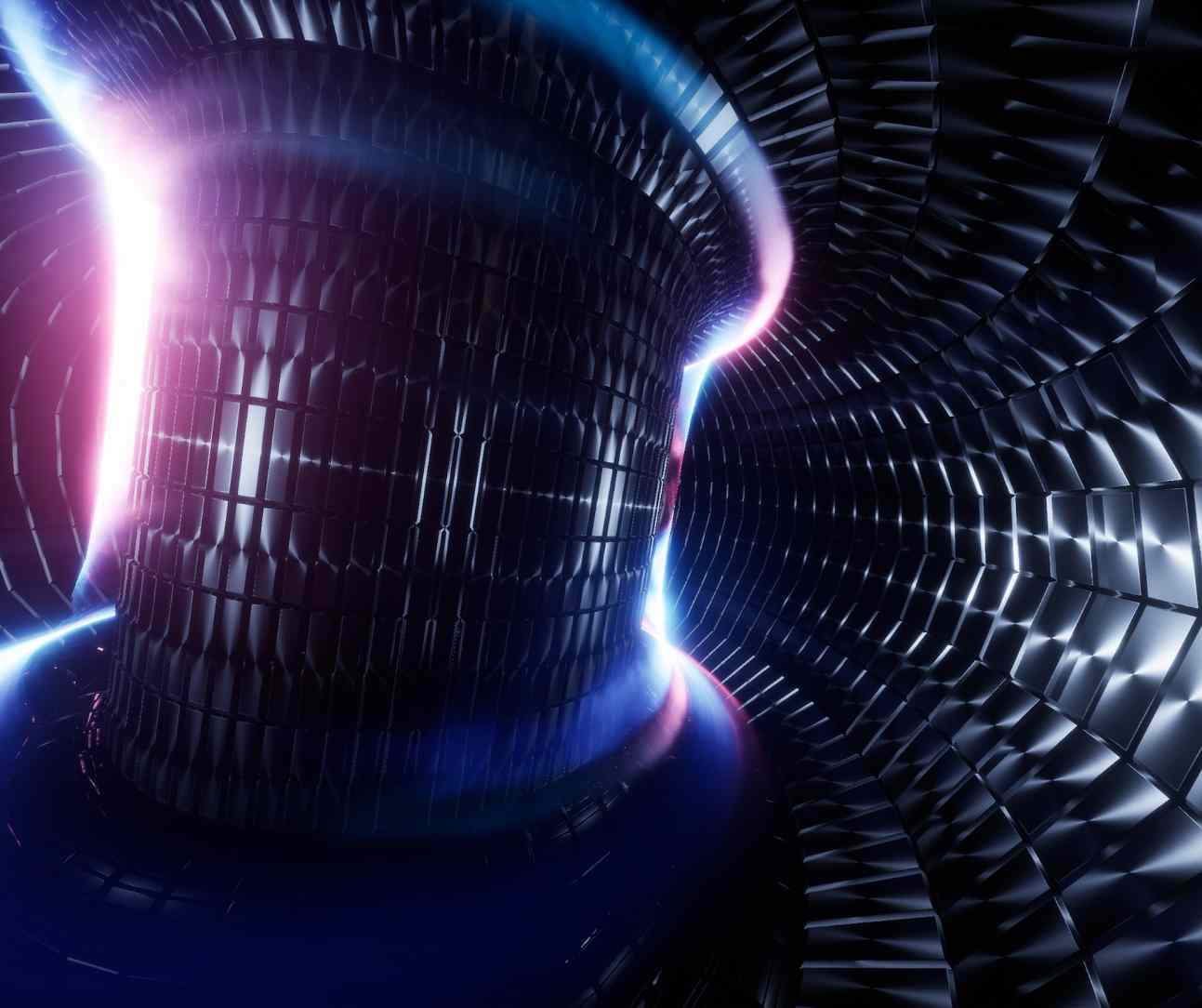

The centerpiece of the event was Tesla’s Cybercab Robotaxi, an autonomous vehicle designed without a steering wheel or pedals, aimed at a price under $30,000 (approximately €27,000). Musk also revealed that the average operating cost of the vehicle is projected to be just $0.20 per mile, making it an affordable choice for many. This Robotaxi promises to be fully autonomous, relying solely on cameras and artificial intelligence for navigation.

In addition to the Cybercab, Musk also presented the Robovan, a vehicle capable of seating up to 20 people. Moreover, Tesla unveiled a new version of its humanoid robot, “Optimus,” designed for use in Tesla’s factories and potentially beyond. Despite these technological advances, some investors remained skeptical, as the event lacked significant surprises beyond what had been previously hinted.

Investor Reactions: Optimism or Caution?

Despite the excitement around the Robotaxi unveil, investor reactions have been somewhat mixed. Elon Musk’s ambitious vision for the future included statements about moving from supervised to unsupervised Full-Self Driving (FSD) technology by next year. It will focus initially on Texas and California. Musk expressed confidence in these milestones, but he has a track record of being overly optimistic regarding timelines.

With shares already down 4% this year, it is uncertain if the Robotaxi reveal will be enough to rekindle investor confidence. The current state of competition, and regulatory hurdles are all factors keeping Tesla’s growth trajectory in question.

Tesla’s Path Forward

The launch of the Cybercab marks a crucial pivot for Tesla—one that moves the focus from consumer electric vehicles to autonomous ride-hailing services. However, many challenges still lie ahead. Tesla’s rivals have already deployed autonomous vehicles in certain regions.

Furthermore, Tesla is not immune to the broader industry challenges. Its core car sales have faced a decline over the past two quarters, and investors are eager to see whether autonomous vehicle production can help reverse this trend. Despite Tesla’s significant progress, the road to fully autonomous vehicles becoming commonplace is still filled with regulatory, technical, and societal hurdles.

Conclusion: Is the Future Autonomous?

The Robotaxi unveil shows Elon Musk’s bold vision of a future dominated by affordable autonomous vehicles. They promise both environmental and financial benefits for consumers. However, given Tesla’s current stock trajectory and industry competition, investors remain cautious. They doubt whether this vision can be realized in the near term.

The next few years will be critical for Tesla—with mass production of the Cybercab projected to begin in 2026, the company will need to prove its ability to overcome regulatory challenges, deliver on its promises, and maintain its lead in autonomous technology. For now, the unveiling has certainly sparked interest, but whether it will ignite the stock market remains to be seen.